Welcome to an in-depth look at Sage Business Cloud Payroll Professional! If you are looking to streamline your payroll processes and make your business operations more efficient, then you’re in the right place. This comprehensive payroll software offers a wide range of features to help you manage and automate your payroll tasks with ease. Say goodbye to manual calculations and time-consuming processes, as Sage Business Cloud Payroll Professional simplifies everything for you. Let’s dive into how this software can revolutionize the way you handle payroll in your organization.

Introduction to Sage Business Cloud Payroll Professional

Sage Business Cloud Payroll Professional is a comprehensive cloud-based payroll solution designed for small and medium-sized businesses. With this software, businesses can efficiently manage their payroll processes, from calculating wages to generating pay slips and submitting tax filings. This user-friendly platform streamlines payroll tasks and eliminates the need for manual calculations, saving time and reducing the risk of errors.

One of the key features of Sage Business Cloud Payroll Professional is its flexibility and scalability. Whether a business has a handful of employees or a large workforce, this software can easily accommodate their needs. Users can customize settings to match their specific payroll requirements and easily add or remove employees as needed. This scalability makes Sage Business Cloud Payroll Professional an ideal solution for businesses of all sizes.

Another standout feature of Sage Business Cloud Payroll Professional is its compliance with tax regulations and industry standards. The software automatically updates tax rates and rules, ensuring that businesses remain compliant with local tax laws. Additionally, Sage Business Cloud Payroll Professional generates reports that can be easily shared with tax authorities, saving businesses time and effort when it comes to filing taxes.

Furthermore, Sage Business Cloud Payroll Professional offers secure data storage and backup capabilities. Businesses can rest assured that their sensitive payroll information is safe and protected from unauthorized access. In the event of data loss or system failure, users can easily retrieve their information from the cloud-based platform, minimizing disruptions to their payroll processes.

In conclusion, Sage Business Cloud Payroll Professional is a reliable and efficient payroll solution that simplifies payroll management for businesses of all sizes. With its user-friendly interface, scalability, compliance features, and data security measures, this software is a valuable tool for streamlining payroll processes and ensuring accuracy and compliance. Businesses looking to automate and optimize their payroll operations can benefit greatly from implementing Sage Business Cloud Payroll Professional.

Features and Benefits of Sage Business Cloud Payroll Professional

Sage Business Cloud Payroll Professional is a comprehensive payroll management solution designed to streamline payroll processes for businesses of all sizes. With a wide range of features and benefits, this software offers unmatched efficiency and accuracy when it comes to managing employee payroll. Let’s take a closer look at some of the key features and benefits of Sage Business Cloud Payroll Professional:

1. Employee Management: Sage Business Cloud Payroll Professional allows you to easily manage all aspects of your employees’ payroll information in one centralized system. From onboarding new employees to tracking time and attendance, this software simplifies the process of managing employee data.

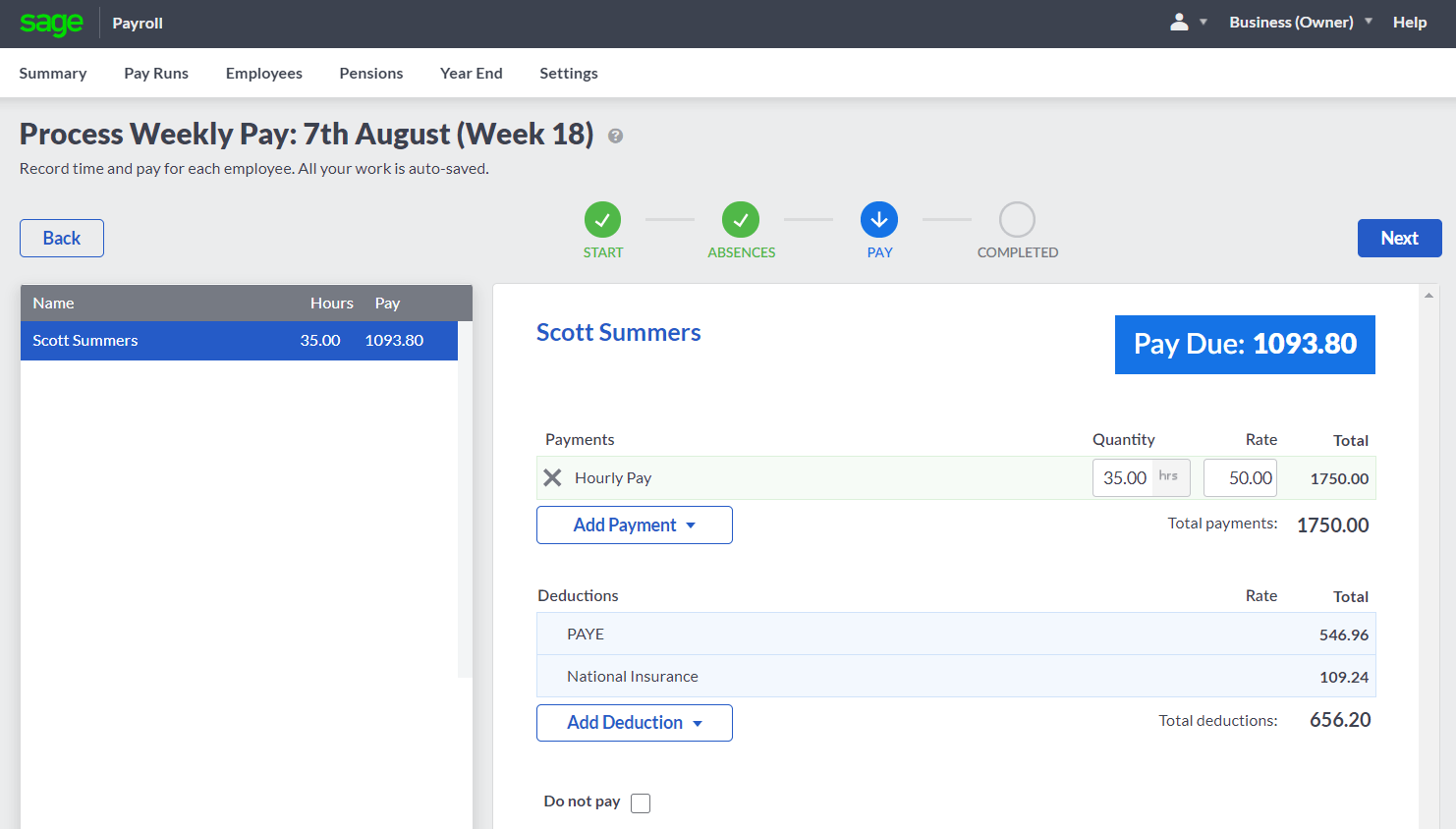

2. Automated Payroll Processing: One of the standout features of Sage Business Cloud Payroll Professional is its ability to automate the payroll processing workflow. With this software, you can set up recurring payroll schedules, define pay rates, and calculate deductions with ease. This automation not only saves time but also reduces the risk of errors in payroll calculations.

Furthermore, Sage Business Cloud Payroll Professional allows you to generate detailed reports on payroll expenses, employee earnings, and tax liabilities. These reports provide valuable insights into your payroll costs and help you make informed business decisions.

3. Compliance Management: Staying compliant with ever-changing payroll regulations can be a daunting task for businesses. Sage Business Cloud Payroll Professional simplifies compliance management by automatically updating tax tables and staying up-to-date with the latest legislation. This ensures that your business remains compliant with local tax laws and regulations.

4. Data Security: Protecting sensitive employee data is crucial for any business. Sage Business Cloud Payroll Professional offers robust data security features to keep your payroll information safe and secure. With advanced encryption and secure cloud storage, you can trust that your data is protected from unauthorized access.

5. Self-Service Portal: Sage Business Cloud Payroll Professional includes a self-service portal that empowers employees to access their payroll information anytime, anywhere. From viewing pay stubs to updating personal information, employees can conveniently manage their payroll details without having to rely on HR or payroll administrators.

Overall, Sage Business Cloud Payroll Professional is a powerful payroll management solution that offers a wide range of features and benefits. From automating payroll processing to ensuring compliance with tax laws, this software simplifies payroll management for businesses and helps them save time and reduce errors. With its user-friendly interface and robust security features, Sage Business Cloud Payroll Professional is a reliable choice for businesses looking to streamline their payroll processes.

How to Set Up and Implement Sage Business Cloud Payroll Professional

Setting up and implementing Sage Business Cloud Payroll Professional is a simple and straightforward process that can help streamline your payroll management. Here’s a detailed guide on how you can set up and implement this powerful payroll software:

1. Account Setup

The first step in setting up Sage Business Cloud Payroll Professional is creating an account. You will need to provide your company details, such as your company name, address, and contact information. Once you have entered all the necessary information, you can proceed to set up your payroll settings.

2. Payroll Settings

After creating your account, the next step is to set up your payroll settings. This includes entering your employees’ details, such as their names, addresses, and tax information. You will also need to specify the pay rates for each employee, as well as any deductions or benefits they may be entitled to. Additionally, you can set up payment frequencies and create payroll schedules for each employee.

3. Customizing Payslips and Reports

One of the key features of Sage Business Cloud Payroll Professional is the ability to customize payslips and reports. You can easily add your company logo, choose a layout that suits your branding, and include any additional information you want to display on employee payslips. This customization can help make your payroll documents look more professional and personalized.

In addition to customized payslips, you can also generate detailed reports to track your payroll expenses, employee wages, taxes, and more. Sage Business Cloud Payroll Professional offers a variety of pre-built reports that you can use or customize to suit your specific needs. These reports can help you stay organized and compliant with tax regulations.

4. Integration with Accounting Software

Sage Business Cloud Payroll Professional seamlessly integrates with accounting software, making it easy to sync your payroll data with your financial records. This integration can help streamline your financial reporting process and ensure that your payroll expenses are accurately reflected in your accounting system.

5. Employee Self-Service Portal

Sage Business Cloud Payroll Professional also offers an employee self-service portal, allowing your employees to access their payslips, tax forms, and other important documents online. This portal can help reduce administrative tasks for your HR department and empower employees to manage their own payroll information.

By following these steps and utilizing the features of Sage Business Cloud Payroll Professional, you can set up and implement a robust payroll system that meets your business needs. Whether you have a small business with a handful of employees or a larger organization with complex payroll requirements, Sage Business Cloud Payroll Professional can help streamline your payroll processes and improve efficiency.

Managing Employee Payroll with Sage Business Cloud Payroll Professional

Managing employee payroll can be a time-consuming and tedious task for small and medium-sized businesses. However, with Sage Business Cloud Payroll Professional, this process is made easy and efficient. This comprehensive payroll solution offers a range of features and tools to help businesses streamline their payroll processes and ensure accurate and timely payments to employees.

One of the key features of Sage Business Cloud Payroll Professional is its ability to automate payroll calculations. This means that businesses no longer have to manually calculate employee wages, deductions, and taxes. The software can handle complex payroll calculations, such as overtime pay, bonuses, and statutory deductions, with ease. This not only saves businesses time and reduces the risk of errors but also ensures that employees are paid accurately and on time.

In addition to automating payroll calculations, Sage Business Cloud Payroll Professional also offers a range of reporting tools. Businesses can generate detailed reports on employee wages, deductions, and taxes, as well as summaries of payroll expenses. These reports can help businesses track their payroll expenses, identify trends, and make informed decisions about their payroll processes.

Another useful feature of Sage Business Cloud Payroll Professional is its integration with other business systems. The software can be seamlessly integrated with accounting software, time and attendance systems, and HR management software. This means that businesses can easily transfer data between different systems, simplifying their payroll processes and ensuring consistency across all areas of their business.

Furthermore, Sage Business Cloud Payroll Professional also offers comprehensive compliance tools. The software automatically updates tax rates and regulations, ensuring that businesses are always compliant with the latest payroll legislation. This helps businesses avoid costly penalties and fines for non-compliance, giving them peace of mind that their payroll processes are in line with regulatory requirements.

Overall, managing employee payroll with Sage Business Cloud Payroll Professional is a seamless and efficient process. The software’s automation features, reporting tools, integration capabilities, and compliance tools make it an ideal solution for businesses looking to streamline their payroll processes and ensure accurate and timely payments to employees.

Integration and Compatibility of Sage Business Cloud Payroll Professional

Sage Business Cloud Payroll Professional is a comprehensive payroll solution that offers seamless integration with a variety of systems and software. It is compatible with popular accounting software such as Sage 50 and QuickBooks, making it easy to transfer payroll data without any manual input. This integrated approach helps to streamline the payroll process and reduce the risk of errors.

One of the key benefits of Sage Business Cloud Payroll Professional is its compatibility with various HR and timekeeping systems. This allows for easy syncing of employee data, time-off requests, and hours worked, making it easier to track and manage employee attendance and performance. By integrating payroll with HR and timekeeping systems, businesses can ensure that all employee information is up to date and accurate, leading to more efficient payroll processing.

Another important aspect of the integration and compatibility of Sage Business Cloud Payroll Professional is its ability to work well with third-party applications. Whether you need to integrate with a benefits administration platform, a scheduling tool, or a performance management system, Sage Business Cloud Payroll Professional can easily connect with these applications through APIs or other integration methods. This flexibility allows businesses to customize their payroll solution to meet their specific needs and easily add or remove integrations as their business grows and evolves.

Sage Business Cloud Payroll Professional also offers seamless integration with electronic payment systems, allowing businesses to easily pay their employees through direct deposit. This eliminates the need for paper checks and manual processing, saving time and reducing the risk of errors. With electronic payment integration, businesses can ensure that their employees are paid accurately and on time, improving employee satisfaction and retention.

Furthermore, Sage Business Cloud Payroll Professional is compatible with a wide range of devices, including desktop computers, laptops, smartphones, and tablets. This allows employees and managers to access payroll information from anywhere at any time, making it easier to review and approve payroll runs, view pay stubs, and make changes to employee records. This accessibility ensures that payroll information is always up to date and easily accessible, improving communication and efficiency within the organization.

In conclusion, the integration and compatibility of Sage Business Cloud Payroll Professional make it a powerful payroll solution for businesses of all sizes. By seamlessly connecting with accounting, HR, timekeeping, and other systems, Sage Business Cloud Payroll Professional helps businesses streamline their payroll process, reduce errors, and improve efficiency. With its compatibility with third-party applications and electronic payment systems, as well as its accessibility from a variety of devices, Sage Business Cloud Payroll Professional offers a comprehensive and flexible solution for managing payroll effectively.