Hey there! If you’re a business owner who works with 1099 contractors, you know how tricky payroll can be. Keeping track of hours, calculating taxes, and ensuring timely payments can be a headache. But fear not, payroll services are here to help streamline the process and make your life a whole lot easier. Whether you’re a small business or a larger enterprise, these services can take the stress out of managing payroll for your contractors, allowing you to focus on growing your business.

Understanding the Difference Between W-2 Employees and 1099 Contractors

Many people often get confused when it comes to understanding the difference between W-2 employees and 1099 contractors. While both may perform similar roles within a company, they are classified differently for tax and legal purposes. W-2 employees are considered traditional employees who work directly for a company and are subject to specific employment laws and regulations. On the other hand, 1099 contractors are considered independent contractors who work on a project or contract basis and are not considered employees of the company they work for.

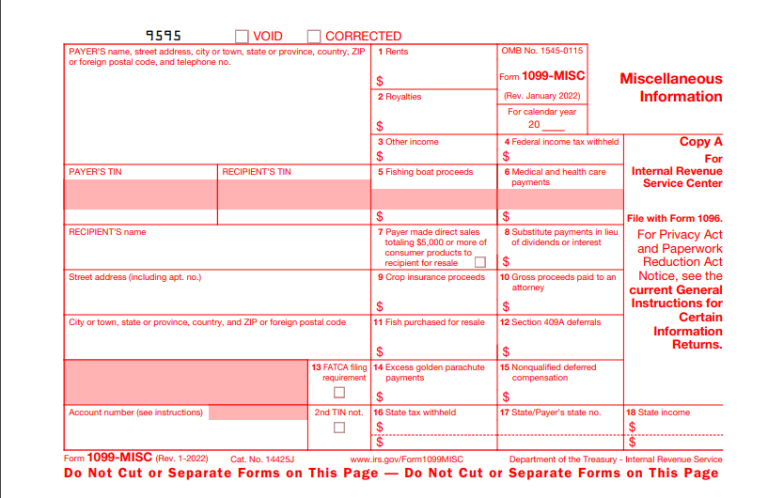

One of the key differences between W-2 employees and 1099 contractors is how they are paid and taxed. W-2 employees receive a regular paycheck from their employer, who withholds taxes, Social Security, and Medicare from their earnings. Employers are also responsible for paying a portion of their employees’ Social Security and Medicare taxes. In contrast, 1099 contractors are responsible for paying their own taxes, including income taxes, Social Security, and Medicare taxes. They are also required to make quarterly estimated tax payments to the IRS.

Another important distinction between W-2 employees and 1099 contractors is the level of control the employer has over their work. W-2 employees are typically managed and supervised by their employer, who sets their work hours, provides them with the necessary tools and equipment, and dictates how the work should be performed. In contrast, 1099 contractors have more autonomy and control over their work. They are usually hired for a specific project or task and are expected to complete it according to the terms of their contract.

From a legal perspective, W-2 employees are entitled to certain benefits and protections that 1099 contractors do not receive. W-2 employees are eligible for benefits such as health insurance, paid time off, retirement plans, and unemployment benefits. They are also protected by federal and state employment laws, such as minimum wage laws, overtime pay, and anti-discrimination laws. In contrast, 1099 contractors are not entitled to these benefits and protections, as they are considered self-employed individuals.

In conclusion, understanding the difference between W-2 employees and 1099 contractors is essential for both employers and workers. Employers must correctly classify their workers to ensure compliance with tax and employment laws, while workers need to understand their rights and responsibilities based on their classification. By knowing the distinctions between W-2 employees and 1099 contractors, both parties can work together effectively and legally within the parameters of their working relationship.

Benefits of Using Payroll Services for 1099 Contractors

When it comes to managing payroll for 1099 contractors, there are several benefits to using payroll services. One of the main advantages is that it can save you time and effort. Payroll can be complex, especially when dealing with contractors who may have varying rates and schedules. By outsourcing your payroll to a professional service, you can free up your time to focus on other aspects of your business.

Another benefit of using payroll services for 1099 contractors is accuracy. Payroll services are experts in ensuring that all payroll calculations are accurate and comply with tax laws. This can help prevent costly mistakes that could result in penalties or fines. By having a dedicated team handle your payroll, you can have peace of mind knowing that everything is being handled correctly.

Additionally, payroll services can provide valuable reporting and analysis. They can generate reports that give you insight into your business’s payroll expenses, helping you make informed decisions about budgeting and forecasting. This data can also be used to track contractor performance and make adjustments as needed.

Payroll services for 1099 contractors also provide a level of security and compliance. They stay up-to-date on changing tax laws and regulations, ensuring that your business remains in compliance with all requirements. This can give you confidence that your payroll practices are legal and above board.

Furthermore, using payroll services can improve the overall professionalism of your business. Contractors appreciate timely and accurate payments, which can help build trust and loyalty. By outsourcing your payroll, you demonstrate that you value your contractors and are committed to providing them with a seamless and efficient payment process.

In conclusion, there are many benefits to using payroll services for 1099 contractors. From saving time and ensuring accuracy to providing valuable reporting and analysis, outsourcing your payroll can help streamline your business operations and foster positive relationships with your contractors. Consider utilizing payroll services to optimize your payroll process and focus on growing your business.

Important Features to Look for in Payroll Services for 1099 Contractors

When it comes to choosing the right payroll service for 1099 contractors, there are several important features that you should consider. These features can help streamline your payroll process, ensure compliance with tax laws, and ultimately save you time and money. Here are some key features to look for when selecting a payroll service for your 1099 contractors:

1. Direct Deposit Options

One of the most convenient features to look for in a payroll service for 1099 contractors is the ability to offer direct deposit options. This allows you to easily pay your contractors electronically, saving both time and hassle. Direct deposit is not only more efficient than paper checks, but it also provides a fast and secure way for contractors to receive their payments. Make sure the payroll service you choose offers this feature to streamline your payment process.

2. Tax Compliance Assistance

Another important feature to look for in a payroll service for 1099 contractors is tax compliance assistance. As a business owner, it’s crucial to ensure that your tax filings are accurate and up to date. A good payroll service will help you stay compliant with tax laws by providing guidance on how to classify your contractors, how to calculate taxes, and how to file tax forms correctly. Look for a payroll service that offers comprehensive tax compliance assistance to avoid any potential penalties or fines.

3. Customized Reporting Tools

Customized reporting tools are essential for tracking and managing payments to your 1099 contractors. Look for a payroll service that offers customizable reporting features, allowing you to easily generate reports based on your specific needs. These reports can provide valuable insights into your contractor payments, helping you track expenses, monitor cash flow, and make informed business decisions. Customized reporting tools can also simplify the process of preparing financial statements and tax reports, saving you time and effort in the long run.

4. Automated Tax Calculations

Automated tax calculations are a must-have feature in a payroll service for 1099 contractors. These tools can help you accurately calculate taxes, deductions, and contributions for each contractor, ensuring compliance with tax laws and regulations. By automating tax calculations, you can reduce the risk of errors and save time on manual calculations. Look for a payroll service that offers automated tax calculation features to streamline your payroll process and avoid costly mistakes.

Overall, choosing the right payroll service for your 1099 contractors is crucial for ensuring smooth and efficient payment processing. By considering these important features, you can select a payroll service that meets your needs and helps you manage your contractor payments effectively.

Common Challenges Faced by 1099 Contractors in Payroll Management

When it comes to managing payroll as a 1099 contractor, there are several challenges that can arise. One of the most common challenges faced by 1099 contractors is the need to accurately track their income and expenses. Unlike traditional employees who receive a regular paycheck, contractors often have multiple sources of income and expenses that need to be carefully documented for tax purposes. This can be especially challenging for contractors who work with multiple clients or projects at the same time.

Another common challenge for 1099 contractors is ensuring timely payments from clients. Unlike employees who are paid on a regular schedule, contractors often have to wait for their clients to process invoices and send payments. This can lead to cash flow problems and make it difficult for contractors to meet their financial obligations.

Additionally, 1099 contractors are responsible for paying their own taxes, including self-employment tax. This can be a complex process, as contractors need to track their income, expenses, and deductions throughout the year to accurately calculate their tax liability. Failure to properly manage tax obligations can result in costly penalties and interest charges from the IRS.

Lastly, 1099 contractors may struggle with compliance issues related to labor laws and regulations. It can be challenging for contractors to stay informed about changes in labor laws, especially if they work in multiple states or industries. Failure to comply with labor laws can result in legal repercussions and damage to a contractor’s reputation.

In conclusion, managing payroll as a 1099 contractor can be a complex process with several challenges. From tracking income and expenses to ensuring timely payments and navigating tax obligations, contractors must be vigilant in managing their financial affairs to avoid potential pitfalls. By seeking out professional payroll services tailored to the needs of 1099 contractors, individuals can streamline their payroll processes and mitigate the risks associated with payroll management.

Best Practices for Ensuring Compliance and Accuracy in Payroll for 1099 Contractors

As an employer utilizing the services of independent contractors, it is crucial to adhere to the laws and regulations governing payroll practices to ensure compliance and accuracy in payment processing. Here are some best practices to consider:

1. Maintain Accurate Records: Keep detailed records of all payments made to 1099 contractors, including invoices, contracts, and time tracking reports. This information is essential for tax reporting and audit purposes.

2. Classify Workers Correctly: It is important to properly classify workers as either employees or independent contractors to avoid misclassification issues. Make sure to follow IRS guidelines and consult with legal counsel if necessary.

3. Timely Payment Processing: Establish a clear payment schedule for 1099 contractors and adhere to it consistently. Late payments can result in dissatisfied contractors and may lead to legal issues.

4. Use Reliable Payroll Software: Invest in reputable payroll software that is specifically designed for managing payments to independent contractors. These tools can streamline the payment process, calculate taxes accurately, and generate reports for easy record-keeping.

5. Conduct Regular Audits: Periodically review your payroll processes to identify any discrepancies or errors. This can help in detecting potential compliance issues and ensuring the accuracy of payments to 1099 contractors.

6. Stay Informed About Regulations: Keep yourself updated on changes in tax laws and regulations that may impact the way you handle payroll for independent contractors. Consult with a tax professional or attend training sessions to stay informed.

7. Communicate Transparently: Maintain open communication with your 1099 contractors regarding payment terms, tax obligations, and any changes in the payroll process. Clear communication can prevent misunderstandings and disputes.

8. Seek Legal Advice When Needed: If you are unsure about any aspect of payroll compliance for independent contractors, seek advice from legal counsel or a tax professional. It is better to clarify any uncertainties upfront to avoid potential legal issues in the future.

By following these best practices, employers can ensure compliance with payroll laws and regulations while maintaining accuracy in payments to 1099 contractors. This not only protects the business from legal liabilities but also fosters a positive relationship with independent contractors, leading to efficient collaboration and successful project outcomes.