Best Payroll Services for Small Businesses

Welcome to our guide on the best payroll services for small businesses! Managing payroll can be a daunting task for small business owners, but with the right tools and services, it doesn’t have to be. From automating payroll processes to ensuring compliance with tax regulations, finding the right payroll service can save you time and money. In this article, we’ll highlight some of the top payroll services that cater to the needs of small businesses, helping you streamline your payroll operations and focus on growing your business.

Cost-effective Payroll Solutions for Small Businesses

When it comes to running a small business, managing payroll can be a daunting task. From calculating salaries to processing tax withholdings, the process can be time-consuming and complex. This is why many small businesses turn to payroll services to help streamline their payroll processes and ensure accuracy and compliance.

One of the key benefits of using a payroll service for small business is cost-effectiveness. These services are often more affordable than hiring a dedicated payroll employee or outsourcing the task to an accountant. With a payroll service, small businesses can pay a flat monthly fee or a per-employee fee, which can be much more cost-effective in the long run.

Another cost-saving aspect of using a payroll service is the time saved on payroll processing. Instead of spending hours each month calculating salaries and taxes, small business owners and their employees can focus on more important tasks, such as growing the business. This increased productivity can ultimately lead to more revenue and growth for the business.

Payroll services also help small businesses save money by reducing the risk of costly errors. Payroll processing can be complex, and mistakes can lead to fines and penalties from tax authorities. By outsourcing this task to a professional payroll service, small businesses can ensure accuracy and compliance, thus avoiding costly mistakes.

Furthermore, payroll services often offer additional benefits that can help small businesses save money. For example, many services offer direct deposit, which can eliminate the need for paper checks and manual processing. This can save small businesses money on paper, printing, and postage costs.

In conclusion, using a payroll service for small business is a cost-effective solution that can help save time, money, and resources. By outsourcing payroll processing to a professional service, small business owners can focus on growing their businesses while ensuring accuracy and compliance. With the many benefits that payroll services offer, it’s no wonder why they are becoming increasingly popular among small businesses.

Customizable Payroll Services to Fit Your Needs

When it comes to managing payroll for a small business, one size does not fit all. Every business has its unique requirements, whether it’s the number of employees, the frequency of payroll processing, or the specific deductions and benefits that need to be accounted for. That’s why finding a payroll service that offers customizable solutions is essential for small businesses.

Customizable payroll services allow small businesses to tailor their payroll processing to fit their specific needs. Whether you’re a small business with just a few employees or a growing company with a larger workforce, a customizable payroll service can adapt to your changing requirements. This flexibility ensures that you only pay for the services you need, saving you money and time in the long run.

One of the key features of customizable payroll services is the ability to choose the level of service that best fits your business. For example, if you have a small team and prefer to handle some aspects of payroll in-house, you can opt for a basic payroll processing package that includes essential services such as calculating wages, taxes, and deductions. On the other hand, if you have a larger workforce and require more comprehensive payroll support, you can select a full-service package that includes additional features like direct deposit, online pay stubs, and tax filing services.

Customizable payroll services also offer flexibility when it comes to how often you process payroll. While some businesses may prefer to run payroll on a weekly basis, others may only need to process it bi-weekly or monthly. With a customizable payroll service, you can choose the frequency that works best for your business, ensuring that your employees are paid accurately and on time.

Another advantage of customizable payroll services is the ability to add on extra features as your business grows. As your workforce expands, you may find yourself needing additional services such as time and attendance tracking, employee benefits administration, or compliance reporting. With a customizable payroll service, you can easily add these features to your package, ensuring that your payroll system can evolve with your business.

In conclusion, customizable payroll services are a valuable asset for small businesses looking to streamline their payroll processes and save time and money. By offering tailored solutions that fit your specific needs, customizable payroll services provide the flexibility and convenience that small businesses need to thrive and grow.

Streamlining Payroll Processes for Small Businesses

When it comes to running a small business, time and resources are limited. This is why it is crucial for small businesses to streamline their payroll processes in order to save time, money, and reduce the risk of errors. By implementing efficient payroll solutions, small businesses can ensure that their employees are paid accurately and on time, while also freeing up valuable resources to focus on other aspects of their business.

There are several ways that small businesses can streamline their payroll processes. One of the most effective methods is to invest in a reliable payroll service that can automate many of the manual tasks involved in processing payroll. These services can help small businesses calculate wages, deductions, and taxes, as well as generate pay stubs and reports with just a few clicks of a button.

Another important aspect of streamlining payroll processes for small businesses is to ensure that all employee information is accurate and up-to-date. This includes details such as hours worked, overtime, sick leave, and any other relevant information that may impact an employee’s pay. By keeping this information current and organized, small businesses can minimize errors and ensure that employees are paid correctly.

It is also important for small businesses to establish a clear payroll schedule and stick to it. This not only helps to ensure that employees are paid on time, but it also provides a sense of consistency and predictability for both employees and employers. By setting a regular payroll schedule, small businesses can avoid last-minute rush jobs and reduce the risk of errors or oversights.

Furthermore, small businesses can streamline their payroll processes by integrating their payroll system with other business software, such as accounting or time tracking systems. This can help to automate data entry and ensure that all systems are in sync, reducing the need for manual data manipulation and minimizing the risk of errors.

Overall, streamlining payroll processes for small businesses is essential for maximizing efficiency, accuracy, and compliance. By investing in a reliable payroll service, keeping employee information up-to-date, establishing a clear payroll schedule, and integrating payroll systems with other business software, small businesses can ensure that their payroll processes run smoothly and effectively, allowing them to focus on growing their business and achieving their goals.

Benefits of Outsourcing Payroll for Small Businesses

Outsourcing payroll services for small businesses can provide numerous advantages, making it a popular choice among business owners. Here are some of the key benefits that come with outsourcing payroll:

1. Time-Saving: One of the most significant benefits of outsourcing payroll for small businesses is the amount of time it saves. Handling payroll in-house can be a time-consuming process, requiring meticulous attention to detail and constant updates on tax laws and regulations. Outsourcing this task allows small business owners to focus on their core business activities, ultimately leading to increased productivity and growth.

2. Cost-Effective: Outsourcing payroll can also be cost-effective for small businesses. By outsourcing payroll services, businesses can avoid the costs associated with hiring and training a dedicated payroll staff or investing in expensive payroll software. Additionally, outsourcing can help prevent costly mistakes and penalties that may occur when managing payroll internally.

3. Compliance and Accuracy: Payroll processing involves numerous complex regulations and calculations that can be difficult to navigate for business owners. Outsourcing payroll to professionals who specialize in this area can help ensure compliance with all relevant laws and regulations, reducing the risk of errors and penalties.

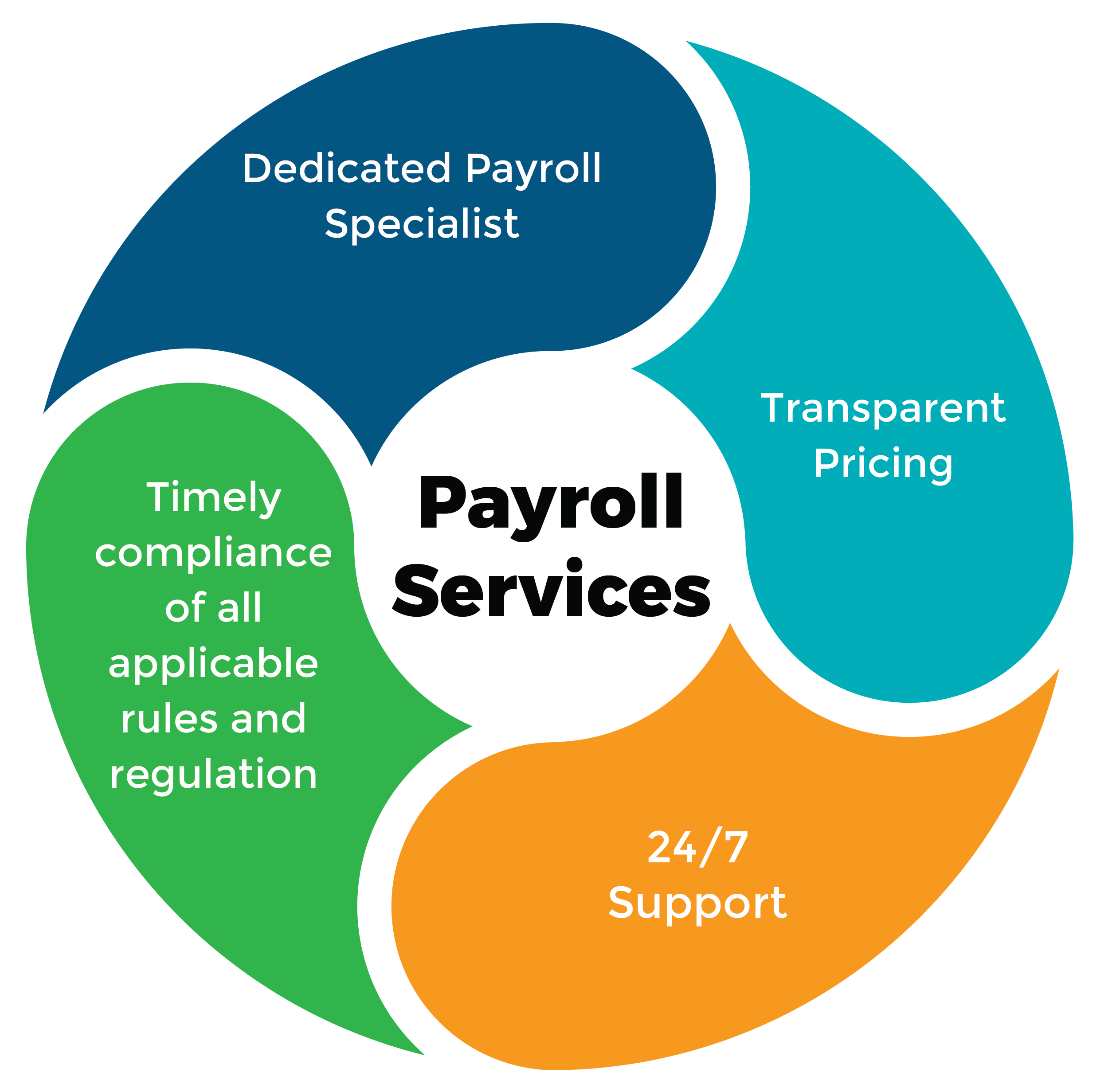

4. Access to Expertise and Technology: By outsourcing payroll, small businesses gain access to a team of experts who have in-depth knowledge and experience in payroll processing. These professionals keep up-to-date with the latest tax laws, regulations, and technology, ensuring that your payroll is processed accurately and efficiently. Additionally, outsourcing payroll services often provide access to advanced payroll software and technology that may be too costly for small businesses to implement on their own.

Overall, outsourcing payroll for small businesses can offer significant benefits in terms of time savings, cost-effectiveness, compliance, accuracy, and access to expertise and technology. By partnering with a reputable payroll service provider, small business owners can streamline their payroll process, reduce administrative burden, and focus on their core business activities.

Choosing the Right Payroll Service Provider for Your Small Business

When it comes to managing payroll for your small business, it is important to choose the right service provider that can meet your specific needs. With so many options available in the market, it can be overwhelming to decide which payroll service provider is the best fit for your business. Here are some key factors to consider when choosing the right payroll service provider:

1. Cost: One of the most important factors to consider when choosing a payroll service provider is the cost. Different providers offer different pricing structures, so make sure to compare the costs of various providers and choose one that fits within your budget. Consider not only the monthly fees but also any additional charges for extra services or add-ons.

2. Services Offered: Another key factor to consider is the range of services offered by the payroll service provider. Some providers offer basic payroll processing, while others may also offer additional services such as tax filing, direct deposit, and HR support. Determine what services are important to your business and choose a provider that can meet those needs.

3. Reputation and Reviews: It is essential to do your research and check the reputation of the payroll service provider before making a decision. Look for online reviews and testimonials from other small business owners to get an idea of the provider’s reliability and customer service. A provider with a good reputation is more likely to deliver quality service.

4. Compliance and Security: Make sure that the payroll service provider you choose is compliant with all relevant laws and regulations. Payroll involves sensitive information, so it is crucial to ensure that the provider has robust security measures in place to protect your data from potential breaches or cyberattacks. Ask about their data security protocols and compliance certifications.

5. Customer Support and Training: When choosing a payroll service provider, consider the level of customer support and training they offer. You want a provider that is responsive to your needs and can provide timely assistance when you have questions or issues. Look for a provider that offers training resources to help you navigate their system effectively and ensure that your payroll processes run smoothly.

Overall, choosing the right payroll service provider for your small business involves careful consideration of cost, services offered, reputation, compliance, security, and customer support. By taking the time to research and compare different providers, you can find a provider that meets your specific needs and helps streamline your payroll processes effectively.